Governments of Denmark & Canada partner with CGS on “Closing the Investment Gap” initiative

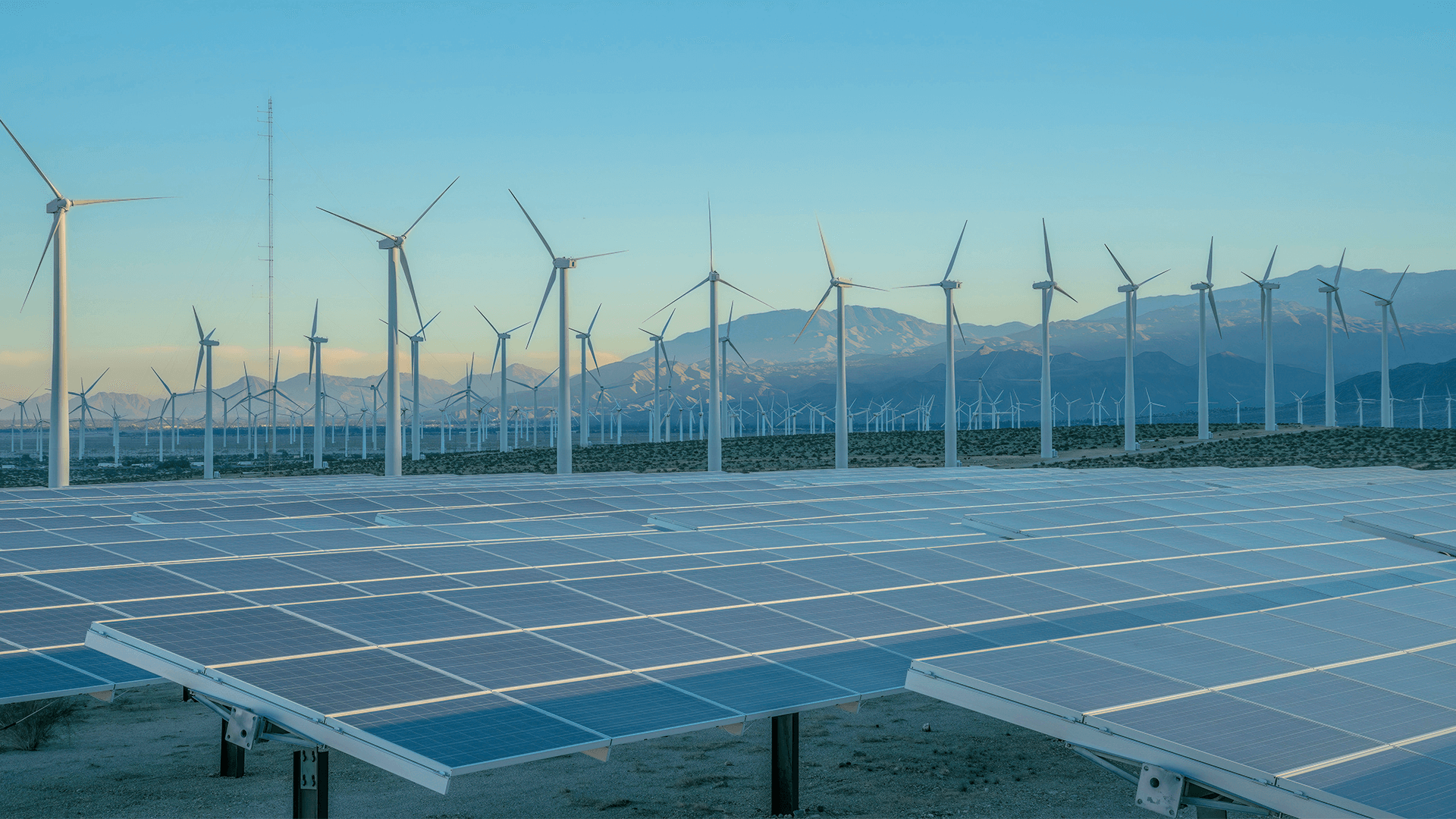

College Park, MD - May 24, 2019 - To meet the targets of global climate agreements and countries’ sustainable development goals (SDGs), annual investments of nearly US$1 trillion in sustainable infrastructure are necessary from now until 2030. However, the investment gap in this funding is significant and persisting. Center for Global Sustainability (CGS) Professor Irv Mintzer is leading the engagement with the Government of Denmark and Government of Canada to tackle that US$ 1 trillion number with a new phase of the Initiative on Closing the Investment Gap in Sustainable Infrastructure (the CIG Initiative).

The CIG Initiative was developed not only to assist developing countries in scaling up investment in climate-smart and resilient sustainable infrastructure projects but also to ensure that those projects are aligned with national development priorities. This process will help developing countries to advance their Nationally Determined Contributions (NDCs) under the Paris Agreement as well as contribute to the SDGs.

Moving forward, the CIG Initiative will link these identified projects in developing countries to funding from private investors. Through a series of international workshops, the team will engage high-level policy-makers from developing countries as well public and private investors from all sectors to develop a pipeline of robust, secure, and cost-effective sustainable infrastructure projects, ultimately creating a self-reinforcing cycle of project funding that will help close the US$1 trillion investment gap.

“The CIG Initiative has created a scalable investment platform and a replicable capacity-building process that can help developing countries move away from financing their high-priority sustainable infrastructure projects with increasing amounts of sovereign debt, and instead create capital-efficient, public-private partnerships that can finance these activities through non-recourse or partial recourse project finance structures,” according to Professor Irv Mintzer.

For more information or to speak to an expert, email Shannon Kennedy at skennedy@umd,edu.