As US states and territories grapple with rebuilding costs and the need for enhanced resilience in the wake of extreme weather events, the Center for Global Sustainability (CGS) released a report today on “Climate Change Risk and the Maryland State Retirement and Pension System.” This analysis recommends specific actions the State of Maryland could take to more fully account for climate related risks facing its state pension system.

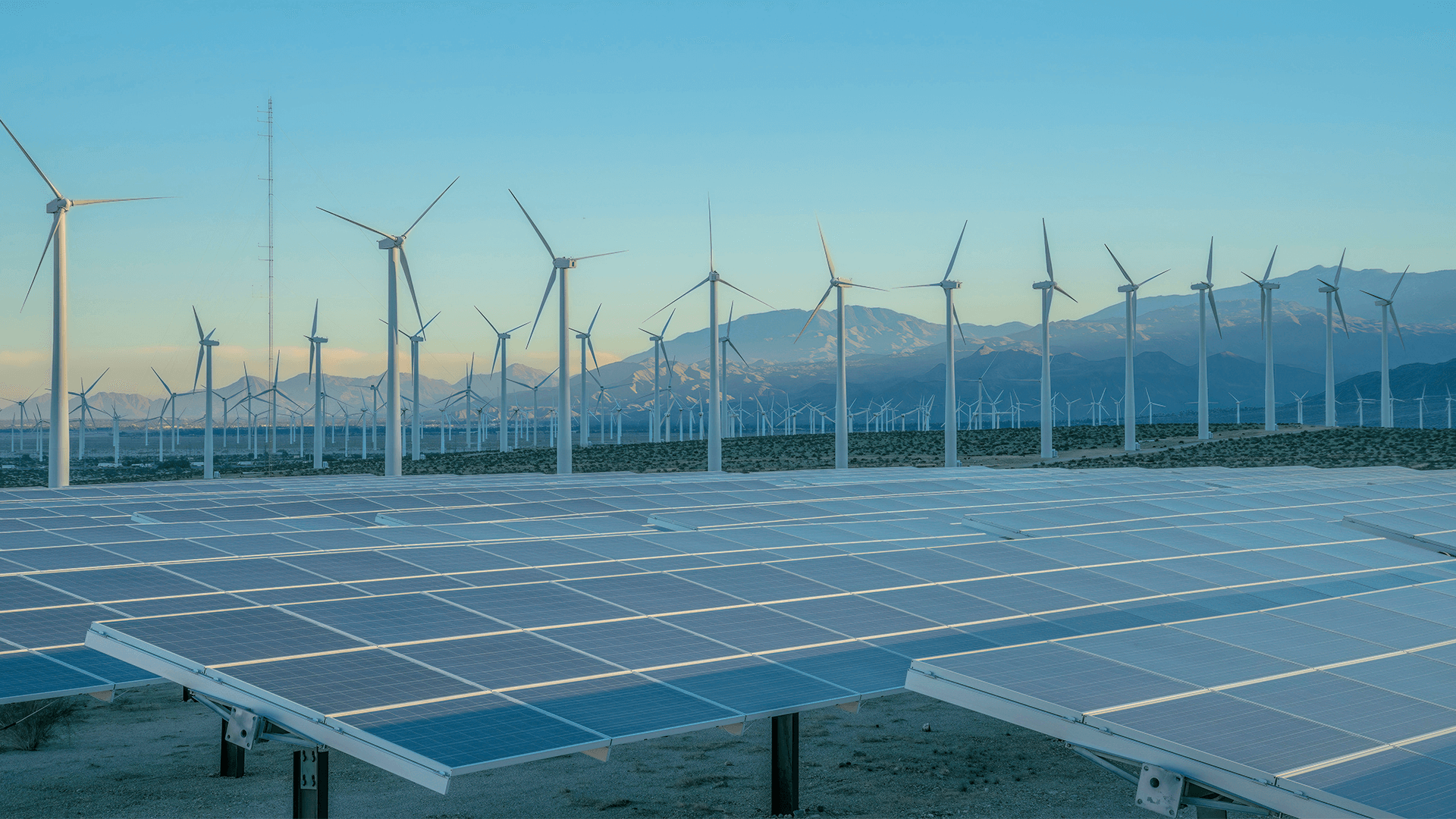

Drawing on research on climate-related investment risks, opportunities, and responsibilities, the report explores the extent to which the Maryland State Retirement and Pension System (SRPS) incorporates such risks in its investment planning and other practices. The report further describes best practices for managing institutional investment portfolios in the face of climate change and offers recommendations for how Maryland SRPS can incorporate climate risk and opportunity into its operations.

Prof. Nathan Hultman, director of the Center for Global Sustainability and one of the report’s authors, said, “States have a unique and valuable role to play in addressing the human and economic costs of climate change. This report outlines the climate-related risks to Maryland’s pension system, describes actions that other states have taken, and outlines steps that our state could take to lead in ways that reflect the best scientific understanding of the risks of climate change.”

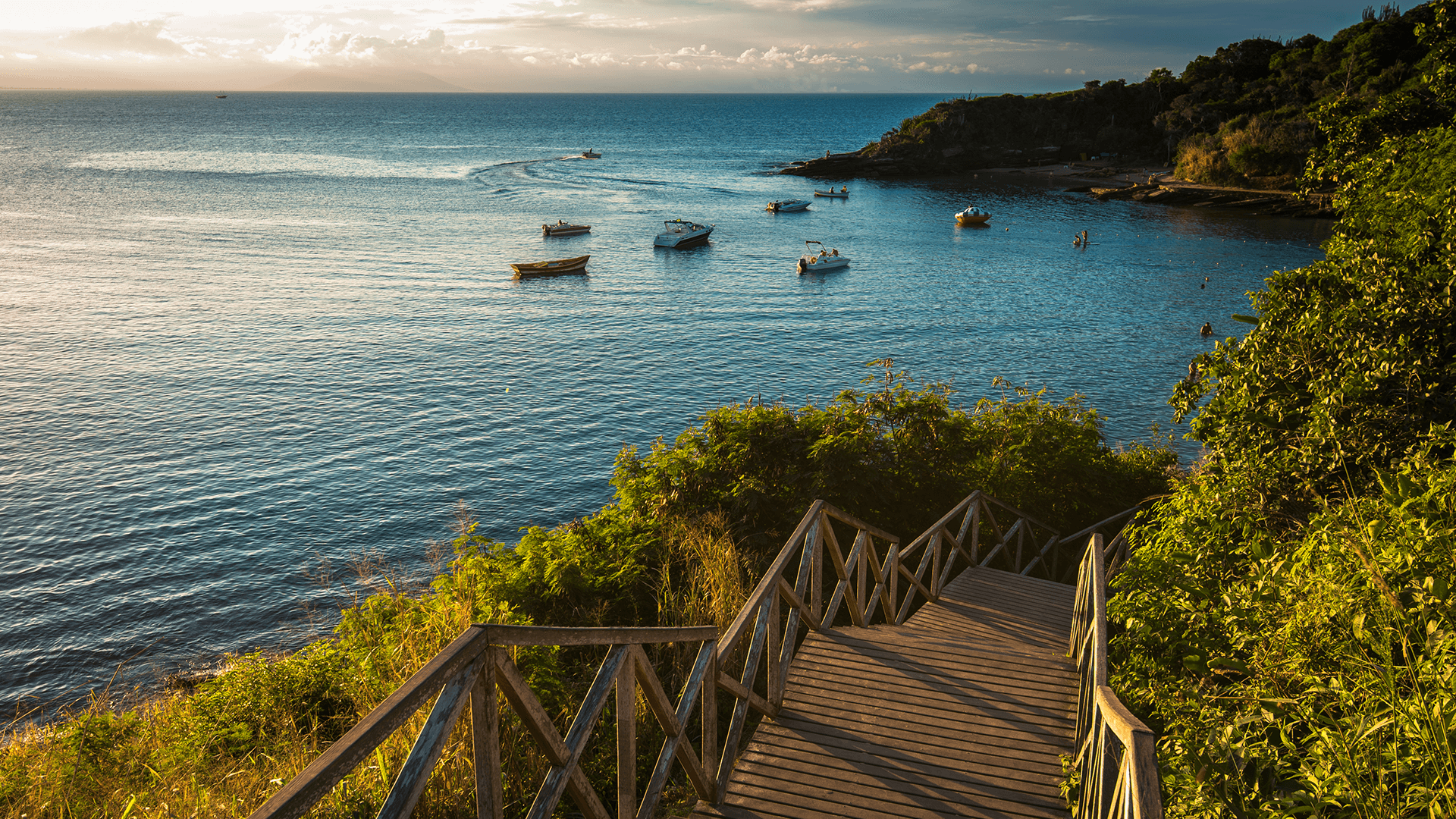

Matthew Binsted and Wes Hanson, both of the Center for Global Sustainability, collaborated with Dr. Hultman and with Alan Miller, independent consultant, and Travis St. Clair of the NYU Wagner Graduate School of Public Service as authors on the report. Mr. Miller notes that “Pension funds have a fiduciary obligation to manage their assets for returns far into the future, in order to meet expectations of pension holders who may not retire for decades. Consequently, consideration of the financial impacts of climate change -- already apparent in the form of insurance losses and damage to coastal properties -- is becoming essential for responsible fund management. This issue has already been recognized in a growing number of states and other countries, and it is time for Maryland to join their ranks.”