A new CGS-led debate paper published in Sustainable Earth Reviews (BioMed Central) examines the UN’s Sustainable Development Goal 8 (SDG 8) in developing countries, using Indonesia as a case study to highlight challenges and strategies for green growth. Indonesia, a key Southeast Asian market, illustrates the complex balance between sustainable development and economic growth and rising electricity demand in remote areas, a prime opportunity for renewable energy solutions.

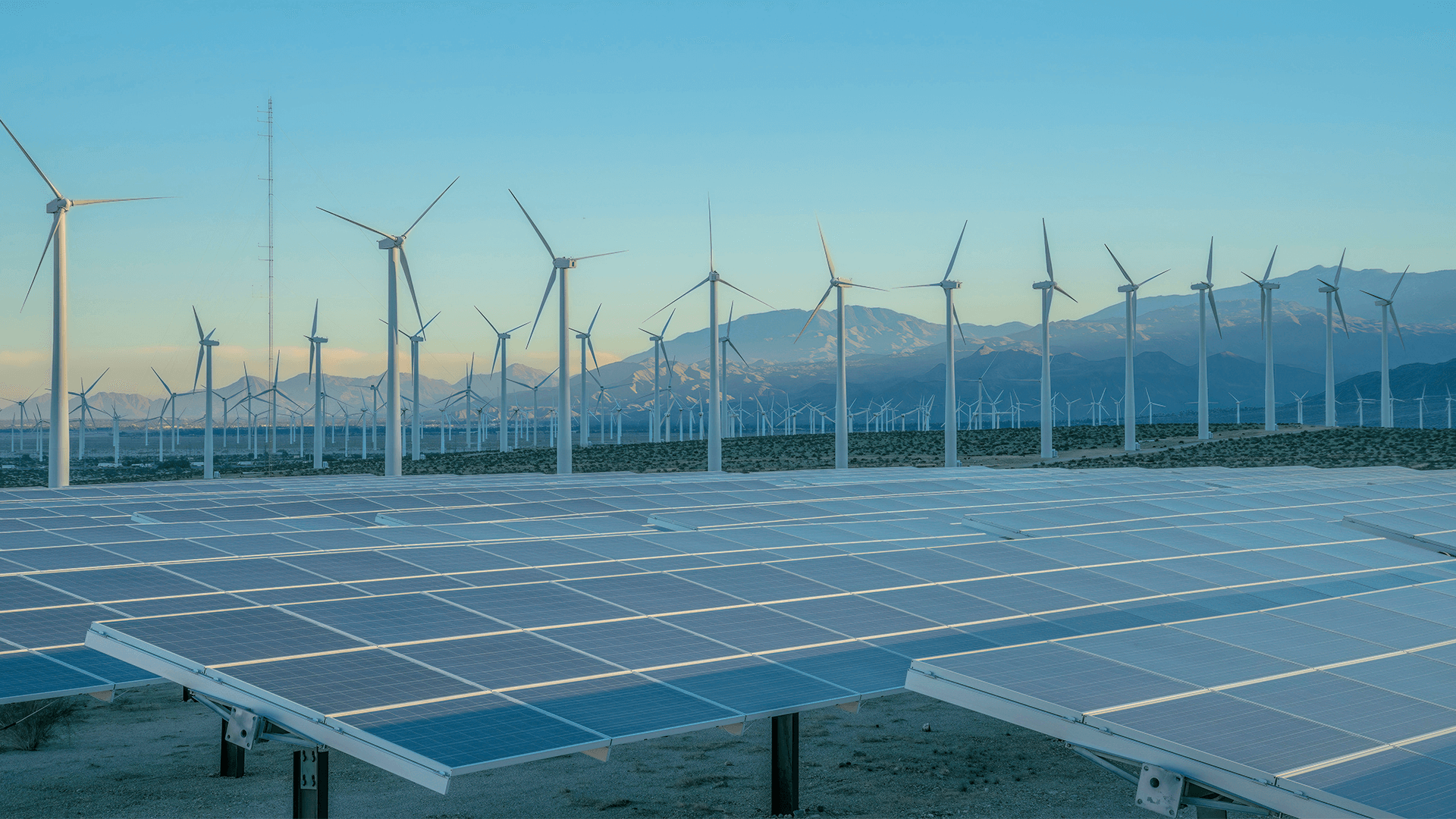

Created by the United Nations in 2015, the 2030 Agenda for Sustainable Development seeks to foster a more sustainable world by 2030. Central to this initiative is SDG 8 on the UN agenda, which focuses on promoting inclusive and sustainable economic growth, productive employment, and decent work for all. For developing countries like Indonesia, transitioning to a low-carbon economy can drive job creation in renewable energy, enhance energy security, and improve health and environmental protection.

Balancing sustainable development with economic growth is key to meeting SDG 8 and limiting global warming to 1.5°C. The Just Energy Transition Partnership (JETP) plays a vital role in Indonesia’s green growth by addressing energy transition, and social and economic impacts. It provides crucial financial, policy, and technical support to ensure an equitable shift to sustainable energy, paving the way for achieving sustainable development under SDG 8. However, for JETP and other initiatives to achieve its environmental and economic goals, Indonesia needs to scale up renewable energy projects, bolster the domestic capital market, and revamp its energy infrastructure.

“Challenges like unsustainable mining and land-use conflicts are obstructing Indonesia’s path to SDG 8. Addressing these issues requires improving the use of available financing and boosting the domestic capital market to minimize future dependence on international funding,” said Jiehong Lou, CGS Assistant Research Director and lead author of the study. “Our analysis serves as a case study to demonstrate the green growth challenges and opportunities in Indonesia, offering insights into the broader implications of SDG 8 for developing countries and the nuanced balance between sustainable development and economic growth.”

Analyzing Indonesia’s electricity consumption, economic growth, and policies, the analysis identifies the country’s significant challenge in fostering inclusive and sustainable economic growth while addressing climate commitments. Household electricity use is high at 42%, straining the fragile power grid and causing regional disparities. Densely populated areas have excess power, while less populated regions face deficits. Despite private-public efforts to deploy renewable energy-based village grids (RVGs), electrification challenges remain, particularly in East Nusa Tenggara, where electrification rates are as low as 72% and more than 13% of villages lack access to the Perusahaan Listrik Negara (PLN) grid, Indonesia's state-owned electricity company. To address these issues and fully benefit from renewable energy, Indonesia needs more supportive investment policies to align economic outcomes with energy justice.

Indonesia has the potential to lead in renewable energy with its rich mineral reserves, large young workforce, and vast tropical land. However, concerns over environmental damage from nickel processing and biomass integration highlight the need for sustainable practices. The country aims to install 3.6 GW of solar PV by 2025, creating over 100,000 high-value-added jobs. Yet, high local content requirements (labor regulations enforced by governments that mandate a certain percentage of goods or services be sourced locally) have increased production costs and quality issues, making domestic solar panels less attractive. While Presidential Regulation No. 112/2022 has improved developer returns, challenges with local content and panel quality persist. To align with sustainable development and climate objectives, Indonesia must boost manufacturing incentives, enhance financing access, and address these quality and cost issues in the solar PV sector.

“To meet rising electricity demand and accelerate renewable energy deployment, mobilizing capital and enhancing domestic financial capacity is essential, as highlighted by SDG 8,” said Audrey Rader, CGS Research Associate and co-author. “Although green finance sources international Partners Group (IPG) and Energy Transition Mechanism (ETM) are available, regulatory and technical barriers limit their effectiveness. Addressing these challenges can improve funding diversity and project success.”

As an emerging economy, Indonesia confronts challenges in policy, resource management, and technical capacity. For a successful energy transition and progress toward SDG 8, it is crucial to enhance domestic financial institutions and integrate with international financing mechanisms. The reliance on PLN and outdated power purchase agreements (PPAs) complicates the funding of renewable projects. Although green bonds and Green Taxonomy 2.0 have the potential to strengthen local financial capacity and lessen reliance on international funds, addressing high verification costs and other barriers is essential for fully capitalizing on international green finance opportunities.

With a comprehensive analysis of Indonesia’s energy and economic landscape, this study offers a blueprint for other emerging economies, guiding policy and investment decisions while aligning with global sustainability goals. To realize its potential as a leader in renewable energy, Indonesia must address complex barriers including outdated infrastructure and international climate finance hurdles, to set a benchmark for other emerging economies on a similar path to sustainable development.

Check out the paper to learn more.