New research published in npj Climate Action, led by CGS Assistant Research Professor Jiehong Lou, assesses corporations’ rationales behind purchasing carbon offsets and their willingness to invest in co-benefits of offsets, especially those directed at local communities. The analysis furnishes a deeper understanding of the factors that shape the corporate decision-making process, unveiling their core priorities and preferences concerning sustainable practices.

As the impacts of climate change continue to increase, concerns over climate risks are compelling companies and organizations to take proactive measures. However, there exists a substantial knowledge deficit when it comes to comprehending the underlying motivations that drive corporations to invest in carbon offsetting, particularly in relation to their prioritization of local co-benefits.

Voluntary initiatives serve as a strategic approach employed by corporations to enhance their environmental performance and foster innovation for climate solutions. This analysis underscores that corporations are motivated to invest in voluntary initiatives, such as voluntary carbon offset (VCO) projects, primarily due to the positive impact they deliver, either on local communities or on the company’s overall reputation.

“Private sector investments can significantly contribute to sustainable development goals and national climate strategies”, said Jiehong Lou, lead author and Assistant Research Professor at the Center for Global Sustainability. “Our analysis provides insights into the motivations driving corporations to voluntarily invest in carbon offsets and their priorities concerning local co-benefits.”

To address climate risks, it is essential to understand corporations’ motivations for VCO investments to support better policy design and encourage additional investments. For instance, VCOs are not only instrumental in delivering sustainable development benefits and emission reductions but also offer corporations the opportunity to increase their climate finance flow while reducing their carbon footprint.

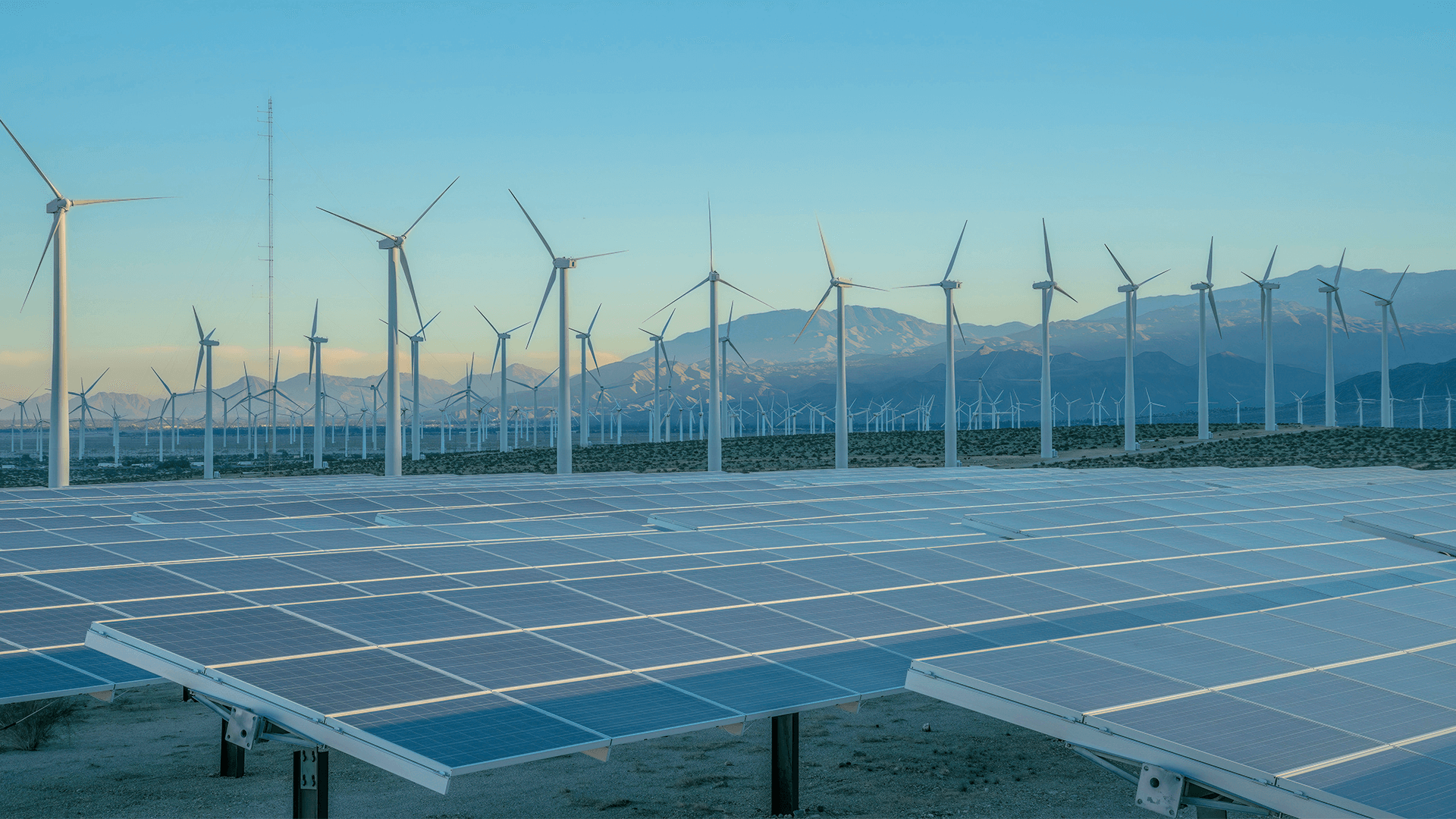

The analysis shows that many companies’ investments in high-cost projects are motivated by market competitiveness and company value because of their co-benefits to local communities. However, companies may prefer investing in low-cost projects, such as renewable energy, because of their operational commitment to emissions reduction.

Check out the full article here.